SEP 2024, Vol 21, Issue 9

Overview

- Federal Judge in Texas Sets Aside FTC’s Noncompete Rule

- Delaware Paid Leave Update

Federal Judge in Texas Sets Aside FTC’s Noncompete Rule

On Aug. 20, Judge Ada E. Brown of the U.S. District Court for the Northern District of Texas ruled in favor of setting aside the Federal Trade Commission’s (FTC’s) recent Non-Compete Clause Rule. Brown found the FTC’s noncompete rule to be unlawful and said it should not be enforced or otherwise take effect on its scheduled date of Sept. 4 or thereafter. This decision means businesses do not need to comply with the FTC’s rule, and it supersedes other federal court decisions in Floridaand Pennsylvania, which had a more limited impact on the rule.

The decision in Texas, rendered in Ryan LLC v. Federal Trade Commission, has significant implications for the viability of the noncompete rule. The ruling is significant because the court concluded that the FTC had “exceeded its statutory authority” in enacting the noncompete rule, therefore finding the rule to be unlawful and barring the FTC from enforcing it nationwide. Many of the issues that Brown identified were also raised by SHRM in its April 2023 public commentand multiple amicus briefssubmitted to the court.

Specifically, Brown said the FTC chose “to impose such a sweeping prohibition—that prohibits entering or enforcing virtually all noncompetes—instead of targeting specific, harmful noncompetes,” which the court believes undermined the legality of the noncompete rule. Brown added that “the record shows the FTC failed to sufficiently address alternatives to issuing the Rule.”

- - - -

Delaware Paid Leave Update

Delaware Paid Leave offers paid leave to employees who have been employed for at least one year and at least 1,250 hours with a single employer. If their leave is approved, employees will get up to 80% of their wages (up to $900 per week) to cover the following:

- Care for a new child (up to 12 weeks per year),

- Care for a family member with a serious health condition (up to 6 weeks, every 24 months),

- Address a personal serious health condition or injury (up to 6 weeks, every 24 months), or

- Assist while loved ones are on overseas military deployment (up to 6 weeks, every 24 months)

Employees are limited to a maximum of 12 weeks of total, combined leave per year.

The program will be funded by less than 1% of an employee’s weekly salary. Employers can require employees to contribute up to half the cost.

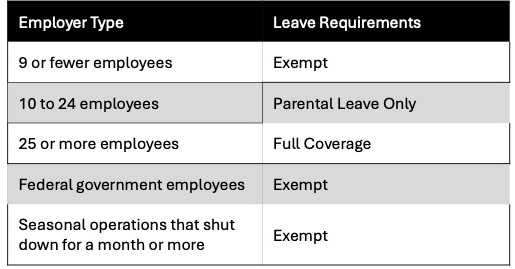

What Businesses Must Comply.

Participating in Delaware Paid Leave is mandatory for most businesses with 10 or more employees working in Delaware.

How does an employer provide the required paid Family and Medical Leave benefits to their employees?

Employers have several different options to provide paid Family and Medical Leave benefits (PFML) to their employees. Employers can:

- participate in the state-sponsored Delaware Paid Leave plan;

- purchase a private insurance plan approved by Delaware Department of Insurance (“DOI”) from an insurance carrier authorized to do business in the State of Delaware; or

- self-insure, if the employer has at least 100 employees, has obtained a surety bond, and agrees to prefund a claims account prior to January 1, 2026.

Upon registering with Delaware LaborFirst, the new online administrative system of the Department of Labor (DOL), employers required to provide PFML benefits to their employees will be automatically enrolled in the state-sponsored Delaware Paid Leave plan. Employers have the option of using an approved private insurance plan as an alternative to the Delaware Paid Leave plan. To do so, employers must apply by December 1, 2024. Delaware LaborFirst goes live September 1, 2024.

Does the private insurance plan have to offer the same benefits as those provided by the Delaware Paid Leave plan?

At a minimum, a private insurance plan must provide at least the same benefits offered by the Delaware Paid Leave plan. A private insurance plan can always offer more generous benefits than are required by the Healthy Delaware Families Act.

When do I apply to use a private insurance plan instead of the Delaware Paid Leave plan to provide paid Family and Medical Leave benefits?

Beginning September 1, 2024, and continuing through December 1, 2024, employers may apply to use an approved private insurance plan through Delaware LaborFirst, the DOL’s new online administrative system. Private insurance plan approval must be renewed on a yearly basis.

How do I apply to use a private insurance plan to provide paid Family and Medical Leave benefits?

Employers will first need to register with Delaware LaborFirst. Once registered, you will have the option, through your employer account, to apply to use a private insurance plan for each line of required coverage as an alternative to the Delaware Paid Leave plan.

If I decide to use a private insurance plan, do I have to provide all lines of coverage through a private plan? Or can I provide one line of coverage through a private plan and participate in the Delaware Paid Leave plan for another?

Employers may use both a private plan and the Delaware Paid Leave plan to provide the required Family and Medical Leave benefits. For example, an employer can purchase a private Medical Leave insurance policy from the list of approved DOI policies and can use the Delaware Paid Leave plan to provide Family Caregiving and Parental Leave benefits.

I have more than 100 employees and would like to self-insure. How do I apply to self-insure?

Employers first need to register with Delaware LaborFirst. Once registered, you will have the option, through your employer account, to apply to self- insure in lieu of using the Delaware Paid Leave plan.

What are the requirements for an employer to self-insure?

In addition to having at least 100 employees, to self-insure, an employer must:

- submit their written self-insurance plan to the Division of Paid Leave (Division) for review and approval;

- provide a surety bond to the State in an amount equal to one year of total contributions that would have been paid by the employer had they participated in the Delaware Paid Leave plan; and

- submit a written acknowledgement that they will establish a prefunded, dedicated bank account from which to pay claims in an amount as determined by the Division by January 1, 2026.

The Division has provided sample documents on its website, de.gov/paidleave, to assist employers who apply to self-insure. Employers will find sample self-insured plan documents, a surety bond and calculation instructions, and an acknowledgement of the requirement to establish a prefunded claims account. During the application process, the employer will upload these documents into Delaware LaborFirst.

- - - -

Contact HR Strategies at 302.376.8595 or info@hrstrategies.org if you would like support or would like to learn more about the items in this newsletter. Please contact us if you would like to be removed from our Monthly Strategies mailing list or if you would like for us to add someone to our mailing list.